Stefanie Stantcheva, a prominent figure in economic research, has gained recognition as the recipient of the prestigious 2025 John Bates Clark Medal, an honor awarded to exceptional economists under 40. A professor at Harvard University, she has made significant strides in understanding tax policy and its effects on innovation and economic behavior. Known for her groundbreaking work, Stantcheva delves into the powerful relationship between taxation and socioeconomic outcomes. Her insights have illuminated how well-designed tax systems can foster innovation, enhancing overall economic health. This award not only celebrates her achievements but also highlights her role as a leading advocate for progressive tax reforms.

In the realm of economic analysis, the contributions of leading scholars like Stefanie Stantcheva are paramount, especially concerning the intersection of taxation and innovation. The John Bates Clark Medal is a coveted recognition that underscores the vital work of economists shaping public finance perspectives. Stantcheva’s exploration of economic behavior sheds light on the intricate dynamics of tax policy and its implications for societal advancement. Her research not only emphasizes the importance of crafting effective economic frameworks but also seeks to unpack the emotional and psychological dimensions that influence public perception of fiscal policies. As discussions around innovation economics evolve, Stantcheva’s findings remain at the forefront, addressing critical issues in trade, immigration, and social mobility.

Stefanie Stantcheva: A Trailblazer in Economic Research

Stefanie Stantcheva has emerged as one of the most influential economists of her generation, particularly recognized for her pioneering contributions in the fields of tax policy and innovation economics. Awarded the prestigious John Bates Clark Medal in 2025, she stands out among under-40 economists for her significant insights and innovative approaches to tackling complex economic problems. Her research delves into the ramifications of tax systems on economic behavior, shedding light on how policy design can either spur or hinder economic activity.

Through her outstanding work, Stantcheva has demonstrated how carefully crafted tax policies can encourage innovation, ultimately fostering a dynamic economic environment. Her groundbreaking paper, “Taxation and Innovation in the 20th Century,” exemplifies her analytical prowess, revealing critical insights on the elasticity of innovation in response to tax policies. This research not only redefines how we understand the link between taxation and innovation but also sets the foundation for future economic strategies that prioritize growth.

The Impact of Tax Policy on Economic Behavior

Tax policy plays a crucial role in shaping economic behavior across various sectors. As highlighted by Stantcheva, a well-structured tax regime can provide the necessary incentives for innovation and entrepreneurship, driving economic growth and development. In her studies, she emphasizes that the impact of taxation is not merely about revenue collection; rather, it encompasses broader implications for how individuals and businesses allocate resources, make investment decisions, and engage in entrepreneurial activities.

Furthermore, Stantcheva’s insights reveal the delicate balance required in tax policy formulation. Too high a tax burden can deter innovation and discourage investment, while effectively designed tax incentives can stimulate research and development. This understanding is vital for policymakers aiming to cultivate an environment conducive to economic advancement, ensuring that tax systems not only finance public goods but also foster robust economic activity and sustainable growth.

Innovation Economics: The Key to Future Prosperity

In the modern economy, innovation serves as a cornerstone of prosperity, and economists like Stefanie Stantcheva are at the forefront of understanding its dynamics. Her research highlights the vital links between tax policy and innovation, illustrating that when designed effectively, tax systems can unleash creativity and technological advancements. This perspective is essential as nations seek to enhance their competitive edge in a rapidly evolving global market.

Stantcheva’s findings reinforce the notion that innovation is highly responsive to external stimuli, particularly tax incentives. For example, investing in research and development can yield significant returns, not only for individual companies but also for the economy at large. By tailoring tax policies that reward innovative efforts, governments can encourage businesses to push boundaries, ultimately leading to breakthroughs that benefit society and enhance economic stability.

Understanding Public Finance through Stefanie Stantcheva’s Lens

Stefanie Stantcheva’s work in public finance has reshaped our understanding of tax systems and their implications for society. She argues that the structure of tax policies is pivotal in addressing economic disparities and fostering inclusiveness in growth. Her comprehensive analysis examines how taxation affects different demographics and the implications of these effects on economic behavior, which is crucial for creating a fair and efficient economic system.

Moreover, Stantcheva’s role at Harvard’s Social Economics Lab allows her to investigate the psychological aspects of economic decisions. By focusing on how emotions and mindsets influence public perceptions of economic policies, she offers a unique perspective that highlights the importance of the social context in economic behavior. This innovative approach not only enriches the discourse on public finance but also lays the groundwork for future research aimed at enhancing policy effectiveness.

Celebrating the John Bates Clark Medal Achievement

The John Bates Clark Medal is a prestigious accolade awarded to economists under 40 who have made significant contributions to their fields. Stefanie Stantcheva’s receipt of this honor not only recognizes her individual achievements but also highlights the exceptional caliber of research emerging from Harvard’s Economics Department. The celebration of her accomplishments reflects the department’s commitment to fostering impactful economic research that can address real-world challenges.

Colleagues and students joined in honoring Stantcheva during a departmental celebration, emphasizing the inspirational nature of her work. The recognition from the American Economic Association reinforces the critical role of innovative economists in shaping public policy and understanding economic behavior. Stantcheva’s influence extends beyond her academic achievements as she continues to mentor the next generation of economists who are set to tackle pressing economic issues.

Exploring Trade, Immigration, and Economic Mobility

Stefanie Stantcheva’s research touches on crucial contemporary topics such as trade, immigration, and social mobility. Her work explores how trade policies can intersect with immigration trends, influencing labor market outcomes and economic growth. By analyzing these dynamics, she provides valuable insights into how nations can craft policies that harness the benefits of trade while addressing potential challenges associated with immigration.

Additionally, Stantcheva’s exploration of social mobility reveals the intricate connections between economic policy and individual opportunities. Understanding how tax systems and public finance affect mobility can inform better policy design aimed at reducing inequality and promoting equitable growth. Her ongoing research in these areas continues to advance the field of economics, offering a holistic view of the interconnectedness of various economic factors.

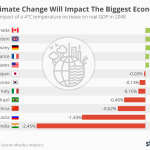

The Role of Economics in Addressing Climate Change

Climate change represents one of the most pressing challenges of our time, and economists like Stefanie Stantcheva are pivotal in developing solutions. Through her research, she investigates the economic implications of climate policies and the ways in which tax incentives can be utilized to promote sustainable practices. Understanding the economic behaviors related to climate change is essential for creating effective policies that mitigate its impacts while driving innovation.

Stantcheva’s focus on climate economics underscores the importance of aligning economic goals with environmental sustainability. Her work illustrates that well-designed tax policies can incentivize green technology and conservation efforts, ultimately contributing to a more sustainable economic future. As the urgency for climate action grows, the insights derived from her research will be invaluable in guiding effective policy interventions at both national and global levels.

Zero-Sum Thinking and Economic Mindsets

Stefanie Stantcheva’s current research examines the psychological dimensions of economic thinking, particularly the concept of zero-sum thinking. This mindset, where individuals perceive resources as fixed and competition as inevitable, can significantly affect economic behavior and policy support. By delving into the intricacies of how people understand economic issues, Stantcheva seeks to unveil the motivations behind public sentiment toward economic policies.

Understanding zero-sum thinking is crucial for economists and policymakers as it can influence how taxation and public spending are perceived. Stantcheva’s work highlights the necessity of addressing these psychological factors to enhance public discourse and build support for inclusive economic policies. By fostering a mindset focused on shared growth and cooperation, economists can encourage greater acceptance and participation in innovative economic solutions.

The Future of Economic Policies under Stefanie Stantcheva’s Guidance

With her impressive track record, Stefanie Stantcheva is positioned to play a leading role in shaping the future of economic policies. Her innovative approach to understanding tax policy and economic behavior will undoubtedly inform the next generation of economic strategies. As she continues her work at the Social Economics Lab, her findings are poised to influence upcoming debates on public finance and economic development.

Moreover, the recognition she has received through the John Bates Clark Medal solidifies her status as a thought leader in economics. Her ability to translate complex economic concepts into actionable insights ensures that her work will have a lasting impact on both academic research and practical policy implementation. Under Stantcheva’s guidance, we can expect significant advancements in the intersection of tax policy, innovation, and economic behavior.

Frequently Asked Questions

Who is Stefanie Stantcheva and what is her contribution to economics?

Stefanie Stantcheva is a prominent economist recognized for her innovative research on tax policy and economic behavior. She was awarded the 2025 John Bates Clark Medal, an accolade given to an under-40 economist for significant contributions to the field. Her work explores the impacts of tax systems on innovation and public finance, providing valuable insights into how these policies influence economic activity.

What is the John Bates Clark Medal and why was Stefanie Stantcheva awarded it?

The John Bates Clark Medal is an esteemed award presented by the American Economic Association to honor outstanding economists under the age of 40. Stefanie Stantcheva was awarded the medal in 2025 for her pioneering research in tax policy and its effects on economic behavior, showcasing how effective tax design can facilitate innovation and economic growth.

How has Stefanie Stantcheva impacted our understanding of tax policy and innovation?

Stefanie Stantcheva has significantly advanced our understanding of tax policy through her research, particularly her 2022 paper ‘Taxation and Innovation in the 20th Century,’ which demonstrated that innovation responds sensitively to changes in tax policy. Her findings indicate that higher taxes can hinder the quantity of innovation while not necessarily affecting the quality, making her work crucial in shaping effective economic strategies.

What research areas does Stefanie Stantcheva focus on in her work?

Stefanie Stantcheva’s research encompasses a variety of topics, including tax policy, innovation economics, public finance, trade, immigration, climate change, and social mobility. She founded the Social Economics Lab to investigate how emotional factors and mindsets influence economic decisions and public policy, showcasing her multidimensional approach to economic research.

What role does tax policy play in innovation according to Stefanie Stantcheva’s research?

According to Stefanie Stantcheva’s research, tax policy plays a critical role in fostering or hindering innovation. She argues that a well-designed tax system can encourage innovation, while poorly designed tax policies may discourage economic activity. Her insights emphasize the importance of crafting tax policies that support economic growth and innovation.

What does Stefanie Stantcheva believe is the relationship between emotions and economic policy?

Stefanie Stantcheva is currently exploring how emotions interact with economic policies as part of her research at the Social Economics Lab. She is investigating key mindsets like zero-sum thinking, highlighting the psychological aspects that shape people’s understanding and acceptance of economic policies.

| Key Points |

|---|

| Stefanie Stantcheva awarded the 2025 John Bates Clark Medal for her contributions to economics. |

| Recognized for insights on tax policy, innovation, and economic behavior. |

| The tax system can significantly influence economic activity and innovation. |

| Research shows high elasticity of innovation in response to tax policy changes. |

| Higher taxes negatively affect the quantity of innovation but not the quality. |

| Stantcheva founded the Social Economics Lab, focusing on pressing economic issues. |

| Current research explores the interplay of emotions and economic policy. |

Summary

Stefanie Stantcheva has been recognized as a leading economist through the prestigious John Bates Clark Medal award for 2025. This accolade not only highlights her significant contributions to tax policy and innovation but also underscores the importance of understanding the impact of economic systems on society. Her ongoing work promises to bring further insights that could shape future economic policies.